The Approach

Agralytica’s approach encompassed over a dozen listening sessions, engaging with growers and insurance providers across diverse regions. We also met with groups like direct marketers, urban farmers, and people from specialized product categories like floriculture. Dozens of one-on-one interviews with farmers and experts further enriched our understanding of the unique challenges faced by these producers.

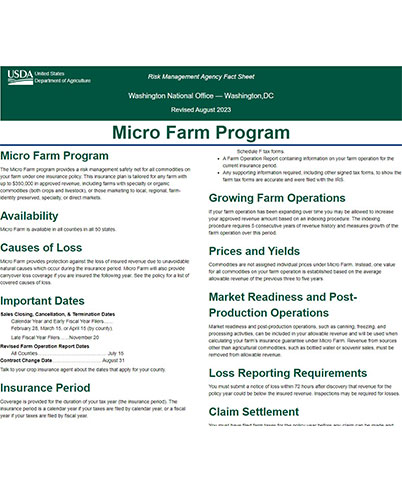

We carefully reviewed all existing programs theoretically available to local and urban growers, identifying the ways in which they failed to meet the needs of these groups. This included detailed analysis of the Whole-Farm Revenue Protection (WFRP) program, the Noninsured Crop Disaster Assistance Program (NAP), Nursery Value Select (NVS), and other existing plans of insurance. Agralytica also proposed a new crop insurance program for local food producers based on an entirely new design.